Acting as a Catalyst for Enterprise Supply Chain & Reducing Its Account Receivables

4Fin offers reliable supply chain financing solutions that benefit both Enterprise/Anchors* and its Channel Partners*. As an innovative lending entity, we specialize in empowering Anchors by offering them hyper-customized financial solutions that enhance their supply chain efficiency. By facilitating smoother transactions and ensuring timely payments, our solutions create a ripple effect, providing immense support to the MSMEs within Anchor’s network. Experience the transformative power of 4Fin’s Supply Chain financing and unlock new avenues of growth for your business ecosystem.

*Definition of Anchor - A Business house that can be a Manufacturer, Distributor, Wholesaler or Dealership that has an established downstream supply chain. 4Fin understands the subtle nuances of Anchor’s Business Model to provide an ideal solution in terms of Account Receivables Management.

*Definition of Channel Partners - The Entities which form part of the downstream network of an Anchor’s Business. Channel Partners often face unique challenges, including limited access to credit and resources. 4Fin makes use of the data provided by the Anchors to fulfill the business potential of such entities.

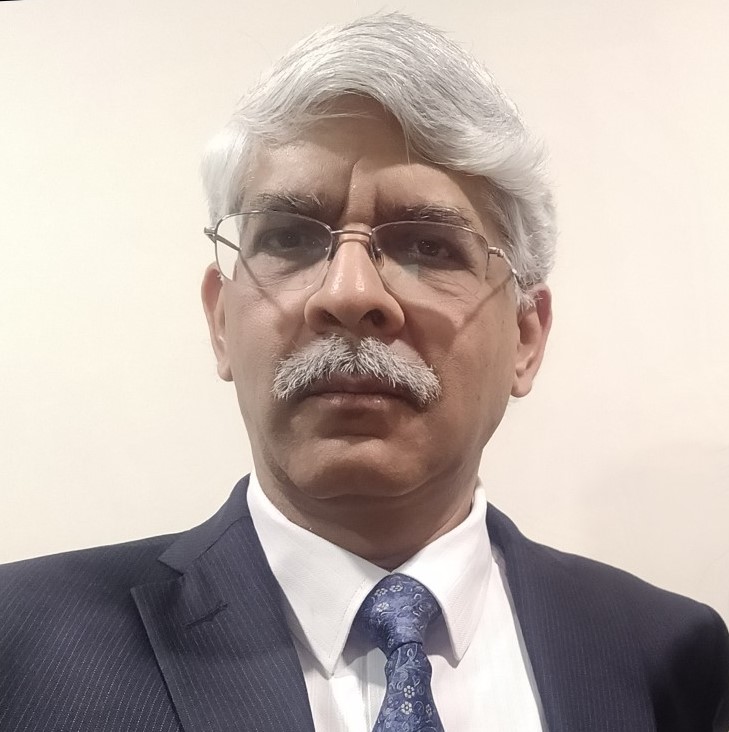

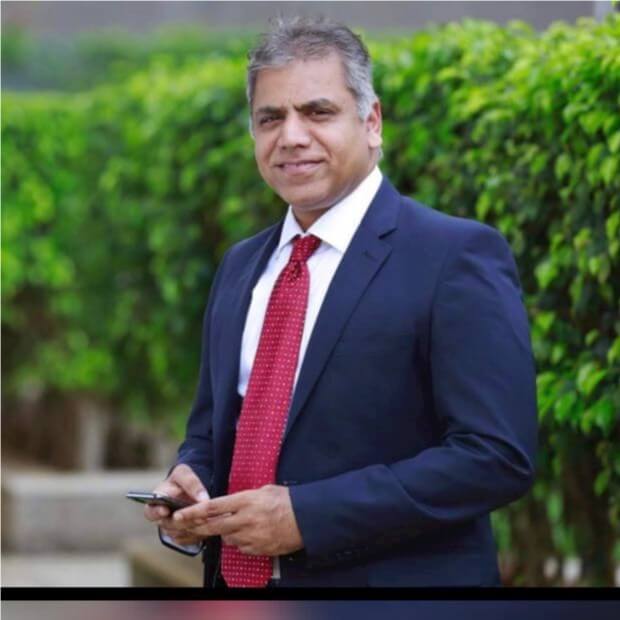

Get in touch

All this with minimal documentation. To know more about the benefits of our lending solutions for your Enterprise, kindly fill out the form: